FHFA announced yesterday that in 2024 the conforming loan limits will rise by $40,000 to $766,550 compared to $726,200 in 2023 for single-family/one-unit properties. This is the base number, as higher-priced homes and regions will have higher limits based on average home prices in the area.

Loan limit increases are correlated to rising prices- the national average home sale price rose by 5.56% which helped determine the 5.5% increase in limits for 2024. The rise in prices in 2023 despite the changing market, inflation, and global uncertainty was due to constrained inventory and high demand.

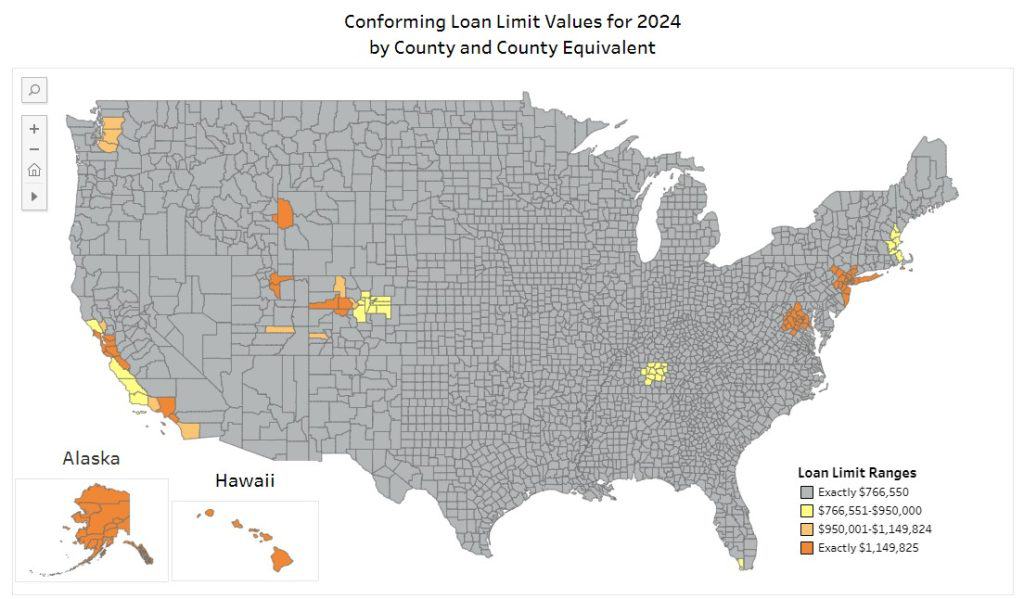

High-cost areas, where 115% of the median home value is higher than the loan limit, will rise to $1,149,825- last year was the first time ever that the limit exceeded a million dollars. In the map below, you’ll see that various areas are considered high-cost areas, including Eastern Massachusetts and the Islands, as well as parts of South Florida.

Click on the map below to view the FHFA Loan Limit Values map:

FHA issued loan limits for 2024 on Tuesday, basing the limits on changes to the conforming loan limit. In low-cost areas, the minimum FHA loan limit for one-unit properties will be $498,257 in 2024. For high-cost areas, the maximum loan amount mirrors the limit set for government-sponsored enterprises in 2024: $1.15 million.