2023 stood out as a significant year in Connecticut real estate. The most notable aspect was the record-low number of homes listed, a trend not witnessed in over two decades. This created an extreme scarcity of inventory and contributed to elevated prices, but it also led to a 22% decrease in the number of sales, leaving buyers eager. As interest rates strive to find equilibrium following their sharp decline in 2020, buyers and sellers have had to accept that the era of pandemic-induced low rates is over, ushering in a period of higher monthly mortgage payments.

2023 stood out as a significant year in Connecticut real estate. The most notable aspect was the record-low number of homes listed, a trend not witnessed in over two decades. This created an extreme scarcity of inventory and contributed to elevated prices, but it also led to a 22% decrease in the number of sales, leaving buyers eager. As interest rates strive to find equilibrium following their sharp decline in 2020, buyers and sellers have had to accept that the era of pandemic-induced low rates is over, ushering in a period of higher monthly mortgage payments.

2022 also experienced a decline in sales compared to 2021 and attention-grabbing headlines raised the fear of an impending price crash. However, Anthony was very clear that was unlikely to happen. Fast forward a year, and there’s still no crash. The resilience can be attributed mostly to the decrease in inventory. The reduction in sales in 2022 was not surprising but rather a relief, considering the unsustainable frenzy of the 2021 market. The slower market activity in the following year reflects a move toward equilibrium. Despite the necessity of a market adjustment, the process can be painful, and 2023 was most certainly not comfortable for anyone involved.

This report analyzes sales, average prices, the number of active listings, and listings under contract for 2023 compared to 2022. Additionally, it predicts what’s going to happen in real estate in 2024.

2023 Real Estate Performance Highlights

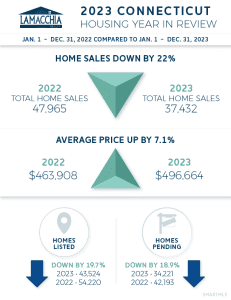

- The number of homes sold decreased by 22%

- Average prices for closed sales increased by 7.1%

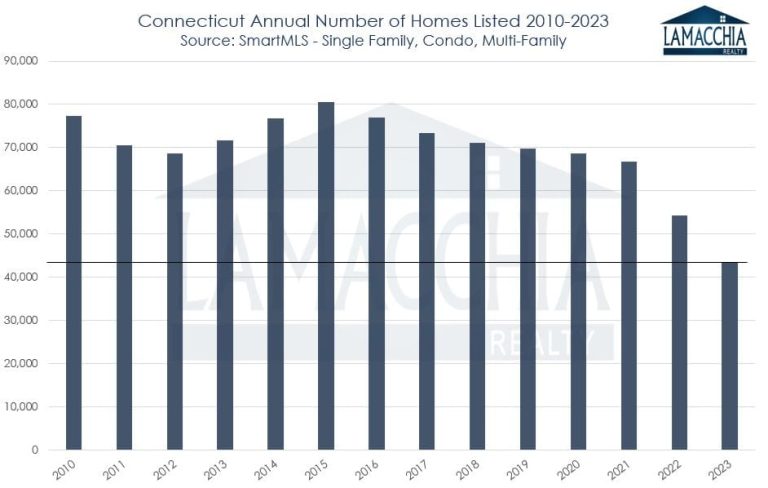

- Lowest number of homes listed in recorded history, decreasing by 19.7%

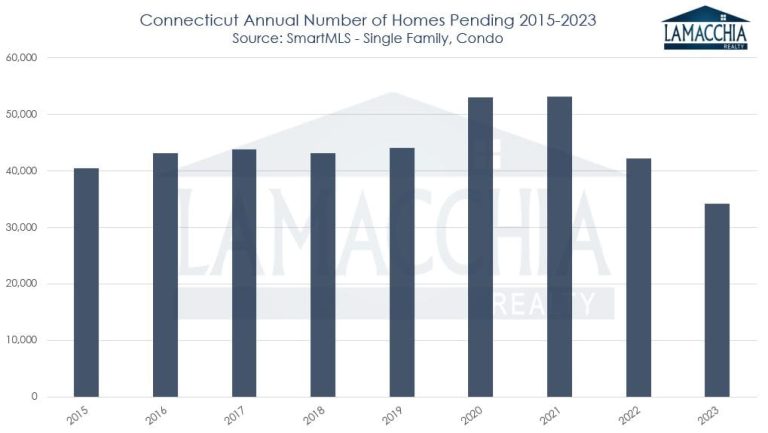

- The number of homes placed under contract (pending, just singles and condos) decreased by 18.9%

- A significant drop in inventory has caused prices to continue their ascent.

- In conclusion… 2024 is predicted to improve slightly, depending on rates and inventory.

Sales Decline by 22%

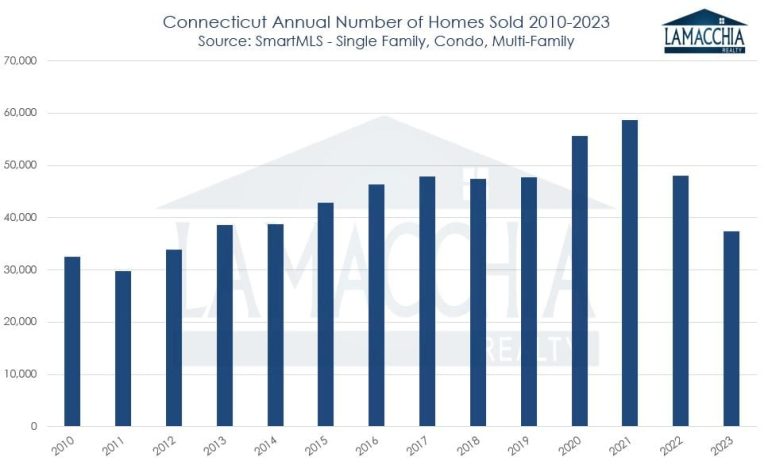

A notable 21.7% decline in sales was observed in Connecticut, with the figures dropping from 47,965 in 2022 to 37,432 by the end of 2023. This represents a substantial decrease of 10,533 sales year-over-year. The decline can be attributed partly to buyers grappling with the affordability challenges posed by higher interest rates and continuously escalating prices. Additionally, a significant contributing factor was the inadequate inventory levels, creating a challenging environment for potential buyers.

Sales were down in all three categories:

- Single family sales decreased by 22.4%: 26,692 in 2023 from 33,974 in 2022

- Condo sales decreased by 20.1%: 7,755 in 2023 from 9,766 in 2022

- Multi-family sales decreased by 29.4%: 2,985 in 2023 from 4,225 in 2022

In the chart below, it’s clear that sales in 2023 were the lowest since 2012. This is the second year that sales have declined by a significant amount as the market attempts to rebound from the 2021 COVID frenzy and sellers cling to their rates and hesitate to sell.

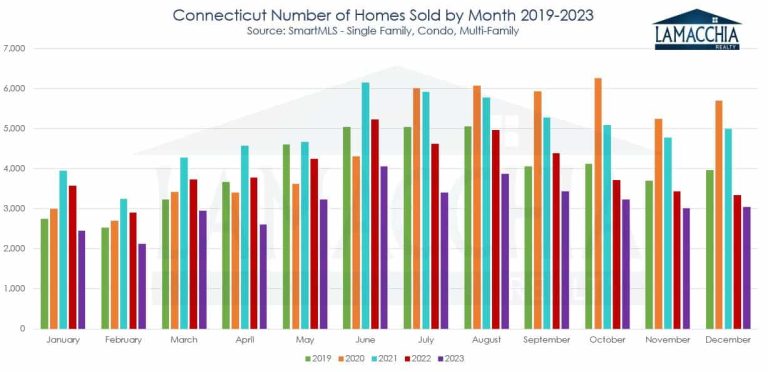

Furthermore, you can see in the bar chart below that every month this year was down from the previous four years, including the pre-pandemic market.

Average Prices Increase by 7.1%

Despite the pressure on affordability, prices continued to increase due to the persistently low inventory, leading motivated buyers to compete with multiple offers and consequently drive up sales prices.

Prices increased in all three categories:

- Single family prices increased by 5.7%: $560,685 in 2023 from $530,635 in 2022

- Condo prices increased by 12.3%: $322,617 in 2023 from $287,228 in 2022

- Multi-family prices increased by 12.1%: $376,350 in 2023 from $335,749 in 2022

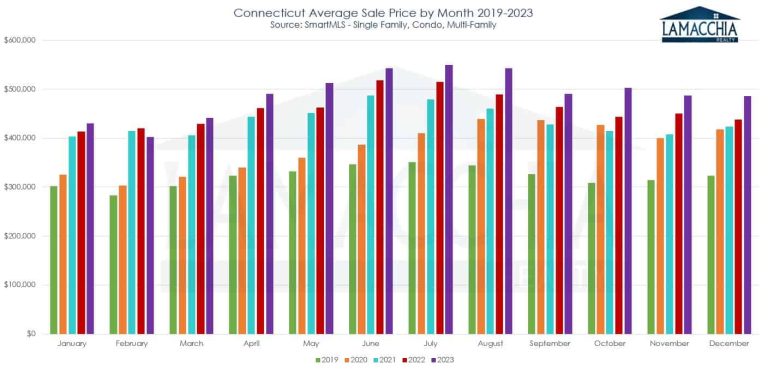

The spike in prices began in 2020 and they haven’t seen much of a reprieve. Inventory was lower this year than we’ve seen in more than two decades and that simmering demand is what keeps prices rising as buyers continue to compete with higher priced offers.

Monthly prices have been up year-over-year fairly regularly for the past four years. In 2023, the only month that was lower than the year before was February.

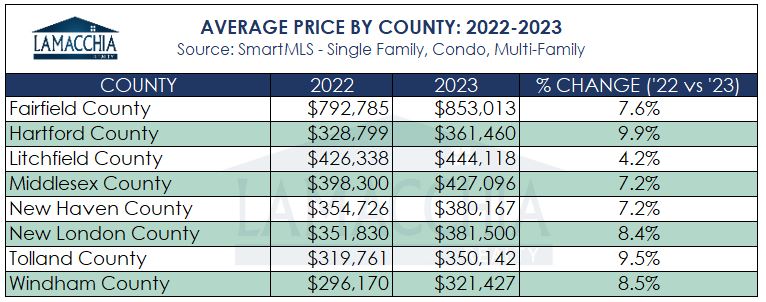

County prices also increased in all regions. People have begun to spread out geographically, and demand is everywhere, and supply is hard to come by.

2023 Sees the Lowest Number of Homes Listed in Thirteen Years

In 2023, listings dropped 19.7% compared to 2022 with 43,524 homes listed, down from 54,220. Sellers hesitated to list their homes, not just to retain pandemic-era rates, but also due to concerns about potentially higher monthly payments when buying again. This has led to the lowest number of new listings since 2010.

Contrary to the belief that interest rates only impact buyers, 2023 shows how sellers are affected. Their reluctance contributes to low inventory, heightening buyer competition and preventing a significant price drop. If inventory increases substantially, concerns about price declines may arise. The current situation, however, reflects the opposite trend.

Pending Sales Decreased by 18.9%

2023 concluded with the fewest pending sales since 2015. The challenge this time was not a lack of demand but rather a scarcity of supply. There were 34,221 homes placed under contract in 2023, marking an 18.9% decline from 2022, which saw 42,193 pending sales. The issue lies in the limited availability of homes for purchase. Please note, that SmartMLS only reports pending sales on condos and single families, multi-families are not included.

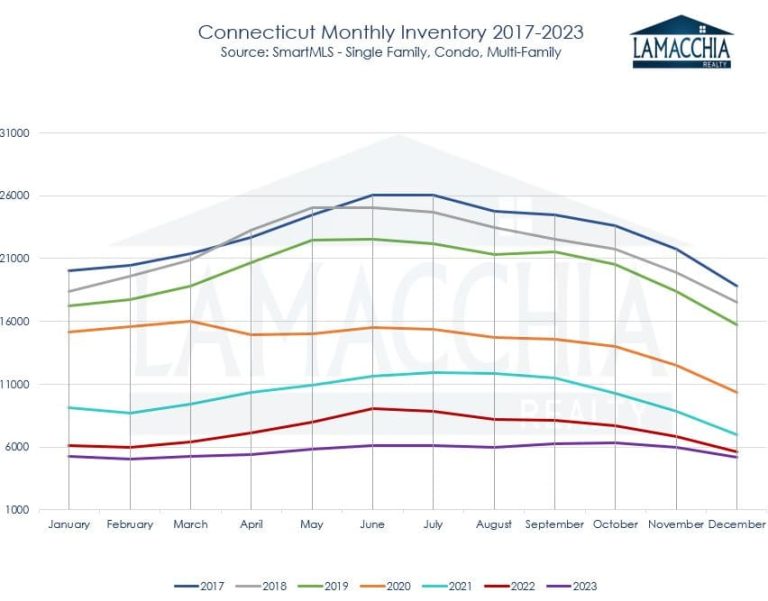

Connecticut Housing Inventory is Incredibly Low

With listings, pending, and closed sales all experiencing declines, the potential for an increase in inventory would normally be looming. If sellers start listing more rapidly, and pending and closed sales continue to decrease, we could see a rise in inventory, putting downward pressure on prices. But, for that to happen, sellers would have to all of a sudden list in the same voracious way that buyers have been buying for a while. Unless this scenario unfolds and sellers continue to sit on their hands, prices are likely to remain consistent, with demand continuing to surpass supply.

In other northeastern states, we have in other northeastern states seen inventory rise a bit above last year at points throughout 2023, but Connecticut is an outlier in that it has remained relatively flat all year and entirely below previous years, without seasonality or global events impacting consumer behavior. It truly goes to show how few sellers are listing and how many buyers are out there struggling to find a home. The more homeowners hear about how tough the market is out there, the longer they decide to stay put. It has been a vicious cycle.

Will the 2024 Real Estate Market Improve?

Mortgage rates at least in other states marginally slowed down buyer activity to slightly assist the increase in inventory, but not in Connecticut. Buyers stayed motivated to buy while sellers took themselves out of the game to maintain their rates and mortgage payments. In 2021, the theme was buyer demand, in 2022, it was rapid increases in mortgage rates, and 2023 was characterized by an incredible lack of inventory. Only highly motivated buyers and sellers, those experiencing life changes like divorce or relocations, were active in the 2023 market.

Looking ahead to 2024, the theme is potentially a reduction in pressure. Anthony’s 2024 Predictions stated, “the worst is behind us, but we are not out of the woods” implying that while the market may remain slow, sales could increase if rates trend down and stay lower. This could motivate sellers to list, leading to a rise in inventory and potentially slowing the upsurge of prices, leveling them off, or even causing a slight decline.

Buyers stand to benefit from lower rates compared to 2023, and mortgage programs like buydowns and mortgage assumptions can contribute to securing lower rates. Sellers, in turn, can and should capitalize on the lower inventory while demand remains high, optimizing their sales if they list now. As rates settle into a new normal, even if in the 6% range, it is historically considered moderate and buyers and sellers will eventually get used to the new rate climate.