SOUTH FLORIDA

Home Sales Down, Average Price Up

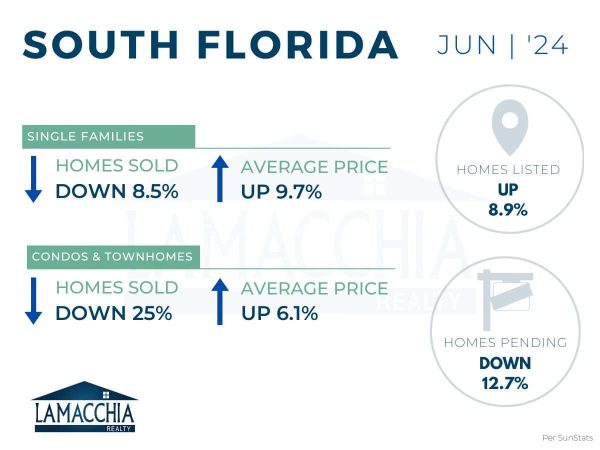

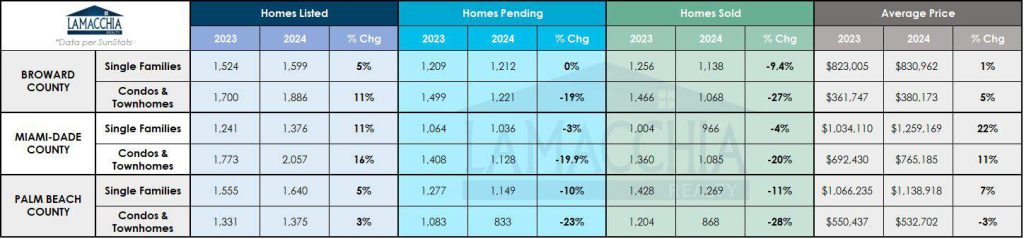

Home sales are down 17.2% year over year, with June 2024 at 6,394 compared to 7,718 last June. Sales are down across all categories.

- Single families: 3,688 (2023) | 3,373 (2024)

- Condos & Townhomes: 4,030 (2023) | 3,021 (2024)

Average sale price increased 11.8% year-over-year, now at $829,878 compared to $742,370 in June 2023. Prices increased across all categories.

- Single families: $974,671 (2023) | $1,069,528 (2024)

- Condos & Townhomes: $529,783 (2023) | $562,305 (2024)

Homes Listed For Sale in South FL:

The number of homes listed is up by 8.9% when compared to June 2023.

- 2024: 9,933

- 2023: 9,124

- 2022: 12,833

Pending Home Sales in South FL:

The number of homes placed under contract is down by 12.7% when compared to June 2023.

- 2024: 6,579

- 2023: 7,540

- 2022: 7,926

Market data provided by SunStats then compared to the prior year.

What’s Happening in the South Florida Market?

- Overall, active inventory in South Florida is up 66% compared to June 2023, with single family inventory being up 46% and condos/townhomes up 80%.

- Clearly, condos & townhomes are contributing significantly to the rise in inventory levels. Condos & townhomes are being listed faster than they are going under agreement as current condo owners would rather list than bear the costs of increased regulations in the form of special assessments, higher HOA fees, increased cost of homeownership insurance, etc.

- For prospective buyers who are already facing other strains on affordability such as increased mortgage rates, increased average sale price, etc., these increased costs put many condo associations outside of their budgets. Therefore, due to lower buyer demand and also longer time on market, we will see more and more price adjustments for condos & townhomes.

- Overall, increased inventory gives buyers more options, and generally, there are fewer buyers in the market right now. Both factors combined have led to a lessening of the intense competition we have been seeing in the market for years.

- The market is no longer in a frenzied state, so homes are sitting on the market longer, and need price adjustments as a result. Nothing is “wrong” with a home that has had a price adjustment! The market has changed and these will become more and more prevalent as time goes on.

- For sellers, more inventory means more competition, especially with fewer buyers in the market. Therefore, pricing your home competitively is critical to generate the most demand for your home to get it sold quickly and for the most money.

- Remember, the housing market is constantly changing, so basing prices on recently sold properties, otherwise known as “comps,” is best.

- Even with more homes being listed for sale, home sales in South Florida were down in the month of June while average sale price continued its upward trajectory – aligning with national housing market data for the month. As inventory continues to increase, price appreciation should flatten out more, or could eventually lead to a reduction in home prices, but we are not there yet.

- Many are waiting for a significant “drop” in mortgage rates, but current market trends suggest that these rates may hold steady for the foreseeable future and become the new “normal”. As such, buyers need to stay prepared and informed of the financing options available to them to make sure they are ready when the time is right!