MASSACHUSETTS

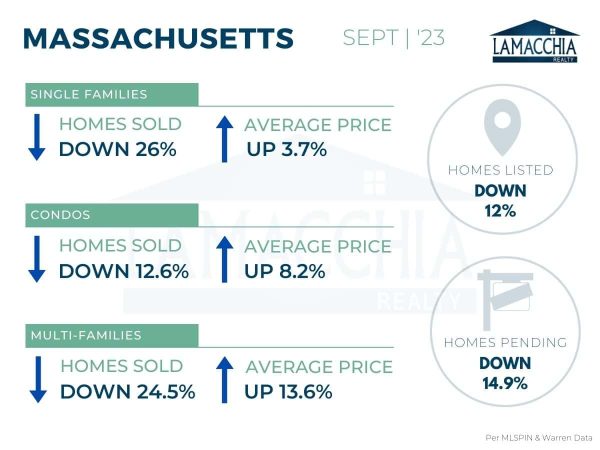

Home Sales Down, Average Prices Up

Home sales are down 22.4% year over year, with September 2023 at 5,791 compared to 7,466 last September. Sales are down across all categories.

- Single families: 4,876 (2022) | 3,608 (2023)

- Condominiums: 1,908 (2022) | 1,668 (2023)

- Multi-families: 682 (2022) | 515 (2023)

Average sales price increased 5.2% year-over-year, now at $684,121 compared to $650,594 in September 2022. Prices increased across all categories.

- Single families: $682,549 (2022) | $707,647 (2023)

- Condominiums: $578,845 (2022) | $626,077 (2023)

- Multi-families: $622,856 (2022) | $707,288 (2023)

Homes Listed For Sale:

The number of homes listed is down by 12% compared to September 2022, want-to-be sellers are concerned about jumping into the market.

- 2023: 7,367

- 2022: 8,373

- 2021: 10,422

Pending Home Sales:

The number of homes placed under contract is down by 14.9% when compared to September 2022.

- 2023: 5,566

- 2022: 6,542

- 2021: 8,936

Price Reductions:

The number of price reductions is down 35.3% when compared to September 2022.

-

- 2023: 561

- 2022: 867

- 2021: 903

Data provided by Warren Group & MLSPIN then compared to the prior year.

What’s Happening in the Market?

Home Sales are down in Massachusetts by 22.4% when compared to September 2022 (specifically, Greater Boston September single-family home sales are their lowest since September 1995). Average sales price has increased 5.2%. Additionally, the number of homes listed is down 12%. Mortgage rates continued to trend upward through the month of September.

What does this mean for Buyers?

- Inventory levels are struggling to keep up with buyer demand in the market which means there are fewer available homes for buyers to choose from. Knowing your mortgage options and keeping your preapprovals updated will help in your search.

- Average price is increasing, but not nearly as drastic as you would expect in a low supply, high demand situation. Affordability remains a chief concern amongst buyers given increased mortgage rates, inflation, etc., but the decrease in overall consumer affordability is what is keeping housing prices from soaring out of control.

- Timing is everything, and to be successful in this market you need to be

prepared and informed! The fall is the best time to buy, and this year is no different! Anthony explains how to be successful during the next 60 days in this market here.

prepared and informed! The fall is the best time to buy, and this year is no different! Anthony explains how to be successful during the next 60 days in this market here.

What does this mean for Sellers?

- It is important to remember that most sellers are also buyers, so they have similar concerns about the current market. As such, many sellers are hesitating to list their homes to avoid losing their low mortgage rate or because they are concerned about availability. Sellers should remember that although rates have increased significantly over the past year, they could continue to go higher, so time is of the essence to list and get their real estate goals accomplished.

- Some sellers can no longer delay putting their home on the market due to changes in life circumstances such as divorce, relocation for work, growing family, etc. If you are a seller who is planning to list this fall, make sure you prep your home accordingly for a successful Fall sale. The more demand you create for your home, the more negotiating power you have – critical for those buying and selling at the same time!

What’s next?

We expect that mortgage rates will continue to rise in the months to come, especially with ongoing international conflicts which impact the U.S. economy. Mortgage rates already hit 8% in mid-October. Additionally, the natural seasonality of the Northeast market will cause it to slow toward the end of 2023, which is why it is so important to jump into the market now if you are a serious buyer or seller.