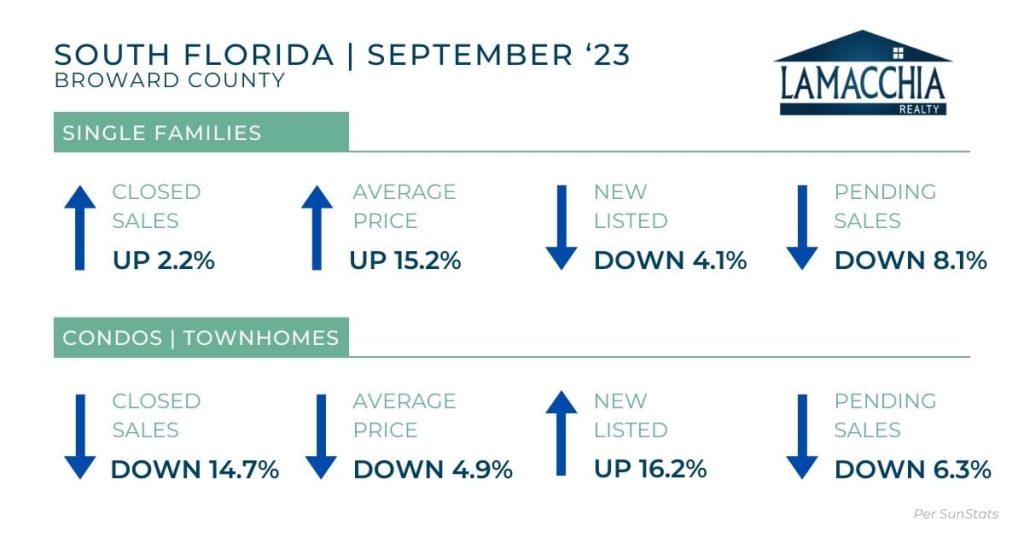

Broward County

In September of 2023, Broward County single-family homes saw decreases in new listings and pending sales but increases in closed sales and average price. Condos/townhomes saw decreases in all categories except for a 16.2% increase in new listings compared to September 2022.

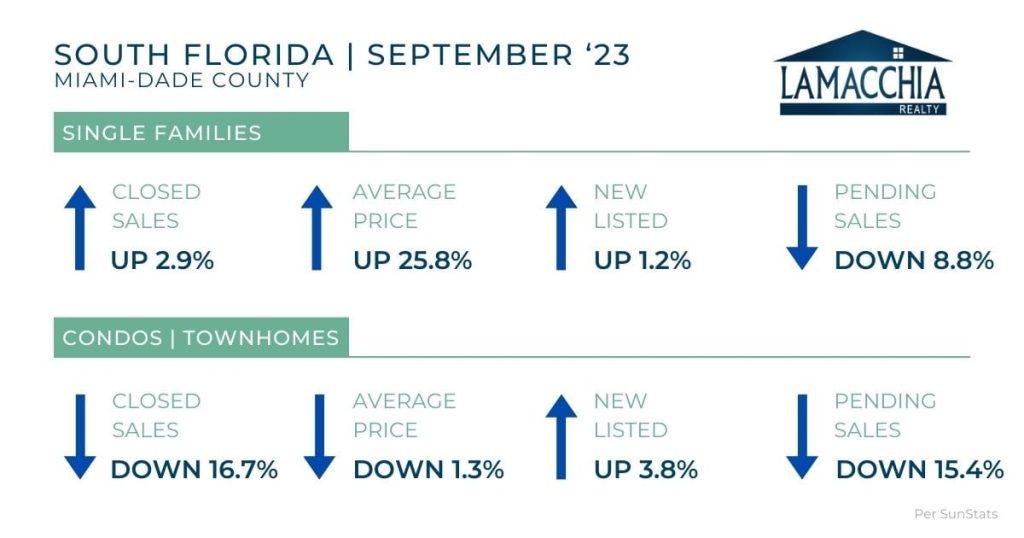

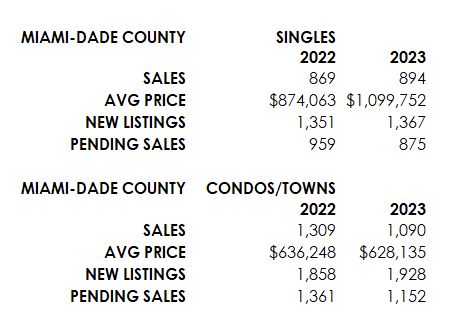

Miami-Dade County

In September of 2023, Miami-Dade single-family homes saw increases in all categories except pending sales, and condos/townhomes saw decreases in closed sales, average price, pending sales, and a slight increase in new listings.

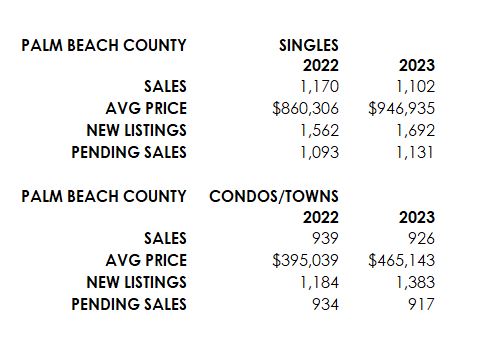

Palm Beach County

In September of 2023, Palm Beach County single-family homes and condos/townhomes both saw a decrease in closed sales, but an increase in average prices and new listings. Single families saw an increase in pending sales whereas condos/townhouses saw a decrease in pending sales.

Data provided by SunStats then compared to the prior year.

What’s happening in the market?

The South Florida real estate market saw an increase in active inventory that can be attributed to not only an increase in new listings but also a decrease in pending sales. In other words, homes are getting listed faster than they are going under agreement. This is especially apparent in the condo/townhome category – most likely attributed to new regulations after the 2021 Surfside Collapse and increased insurance premiums. Home sales are still down when compared to September 2022. Average sales price increased for both single family and condos/townhomes. Broward, Miami-Dade, and Palm Beach Counties all exhibited a mix of these trends as seen in the data above. Additionally, mortgage rates continued to trend upward through the month of September.

What does this mean for Buyers?

- Generally, buyer demand is strong despite ongoing affordability issues caused by mortgage rates, inflation, etc., but in South Florida demand is even stronger as relocating to the Sunshine State has remained a trend well past the initial COVID era flock to sunnier states. As such, the increase in listings and inventory is a good thing for buyers, as more options and availability could lead to less competition and a stabilization or even reduction of prices.

- It is important to note that Hurricane Ian landed in late September 2022 and real estate activity slowed during this time. Even so, listings are inching closer and closer to pre-pandemic levels, which is a good indication of market activity.

- Timing is everything, and to be successful in this market you need to be prepared and informed! Florida’s year-round warmer weather differs from the seasonality seen in the

Northeast. Instead, tourism, snowbirds, etc. create a ‘busy season’ in the spring and summer months making the fall the best time to buy in South Florida – and this year is no different! Anthony explains how to be successful during the next 60 days in this market here.

Northeast. Instead, tourism, snowbirds, etc. create a ‘busy season’ in the spring and summer months making the fall the best time to buy in South Florida – and this year is no different! Anthony explains how to be successful during the next 60 days in this market here.

What does this mean for Sellers?

- Even with a year over year increase in homes listed, many sellers still have reservations about putting their home on the market. Many do not want to give up their low mortgage rate or they have concerns about the lack of options in the market. However, sellers should remember that although rates have increased significantly over the past year, they could continue to go higher, so time is of the essence to list and get their real estate goals accomplished!

- For some sellers, there may be changing life circumstances creating a need to list such as retiring, downsizing, relocating, etc. In these instances, pricing your home competitively will be crucial to attract the most buyers. The more demand you create for your home, the more negotiating power you have – critical for those buying and selling at the same time!

What’s next?

We expect mortgage rates will continue to rise in the months to come, especially with ongoing international conflicts which impact the U.S. economy. Mortgage rates already hit 8% in mid-October. We hope to see a continued trend toward market stabilization for South Florida, especially if inventory continues its upward trend.